The first auditor offers single proprietorship registration in Chennai, Tamil Nadu. We are the top advisors for single proprietorship registration in Chennai, Tamil Nadu. We offer sole proprietorship registration services in Coimbatore, Madurai, Tirupur, Trichy, Thanjavur, Dindigul, Erode, Salem, Namakkal, Karur, hosur, tuticorin, krishnagiri, Cuddalore, Kanyakumari, and Pondicherry. We provide a low-cost online sole proprietorship registration process. We provide the service at a lower cost and more efficiently than our rivals.

Sole Proprietorship Overview

It is an organisation created in a single person's name, as the name would imply. That person is the company's owner, manager, and in charge of all operations. Anyone who wants to start a business can easily form one without having to go through any complicated legal procedures. The sole proprietor must be an Indian national and resident.

Characteristics Of Proprietorship

Ownership

The lone proprietor of the organisation makes all operational choices. The proprietorship is governed and managed by the owner, who also makes and puts into effect modifications. Even though the sole entrepreneur may employ a number of people, it's typical for them to be the only ones.

Unlimited Liability

The sole proprietor, as the only owner of the company, assumes full liability for both the business's debts and its revenue. If the business falters or fails, the owner is personally liable for all obligations, expenses, and payables and creditors may garnish the lone proprietor's wages. The sole proprietor, as the only owner of the company, assumes full liability for both the business's debts and its revenue. If the business falters or fails, the owner is personally liable for all obligations, expenses, and payables, and creditors may garnish the lone proprietor's wages.

Risk

Since the sole proprietorship assumes all of the risk, it is frequently subject to less onerous rules than partnerships and corporations. Even though the firm may need to register its name and operations, the single proprietorship is not necessary to register the company with the state.

Easy Setup

One of a single proprietorship's key advantages is its simplicity of setup. Before beginning operations, independent business entities like corporations and LLCs must submit business formation documents to a state government. It can take weeks and thousands of rupees to prepare the paperwork, file it, and get government permission.

Easy Dissolution

Because there are no legal requirements for its dissolution and it can be done at any moment, it can be done quite easily.

Management

A sole proprietorship can only have one owner, under legal definition. This trait denotes that the owner is ultimately responsible for all actions. A board of directors or a business partner are not responsible to the solo proprietor. To regulate operations and administration, no partnership agreement or bylaws are required.

Flexibility

Due to complete control and limited resources, a sole proprietorship makes it very easy to alter the character of the business in accordance with changes in market trends. For instance, a person operating a fast food restaurant might also operate a clothing store at night.

Free from Legal Formalities

A sole proprietorship is exempt from all legal requirements. Any business may be operated by a lone proprietor as long as no licence is mandated by the law. For example, if someone wants to open a grocery store or clothing store, he will do it. However, if he wants to open a restaurant, he must first seek a licence.

Secrecy

It is a crucial aspect of sole proprietorship as well. The business owner alone makes all of the choices. He is in a position to keep his affairs private and uphold complete secrecy in any situation.

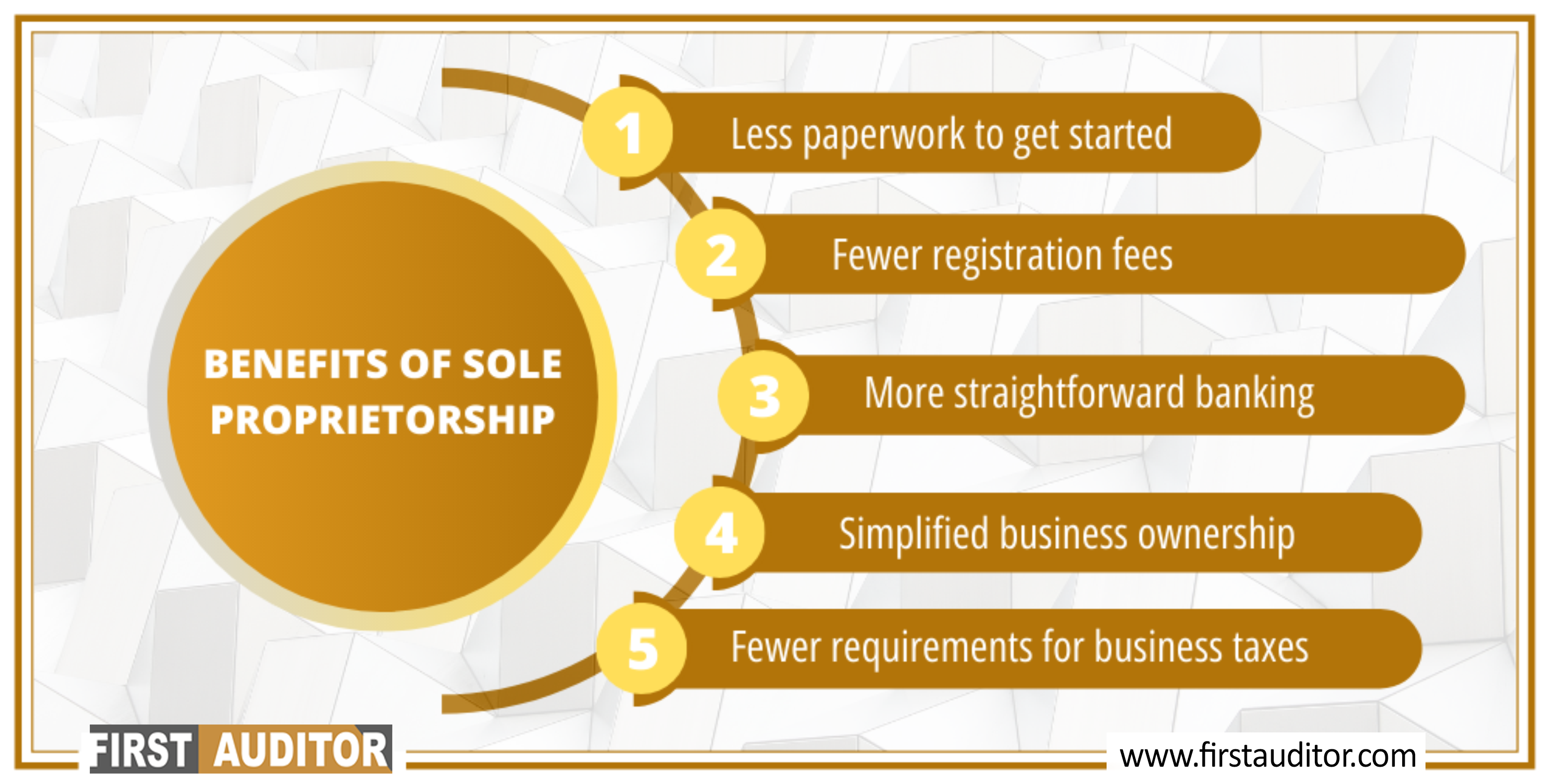

Benefits of Sole Proprietorship

- Less paperwork is required to start.

- Processes that are simpler and with less tax obligations for businesses.

- Decreased registration costs.

- Less complicated banking.

- Ownership of a firm made easier.

Documents for sole proprietorship

- Aadhar Card

- PAN Card

- Bank Account

- Registered office proof

- Registering as SME

- Shop and Establishment Act License

- GST Registration

FAQ

Does Sole Proprietorship need to be registered?

No, it is not necessary to register a sole proprietorship firm in India. It is entirely optional and up to the sole proprietors discretion. Banks, however, demand that the company be registered if the owner or sole proprietor plans to open a bank account in the company's name.

Is GST Registration Mandatory for Sole Proprietorship?

Yes, it is necessary for the proprietor of a small business to register for GST in situations where the annual turnover exceeds the thresholds of Rs. 40 lakhs and Rs. 20 lakhs, the Reverse Charge Mechanism, agents and distributors of input services, e-commerce aggregators, and the provision of information, database, and retrieval services to a person residing outside of India.

What is a Sole Proprietorship Registration?

The phrase "Sole Proprietorship Registration" refers to the process of registering an unregistered company whose owner, manager, and controller is that company's sole proprietor.

Can a Sole Proprietor appoint an Employee?

Yes, a solo entrepreneur has the power to hire workers. The maximum number of employees that a sole proprietor may employ is also uncapped.

Who gets the Profits from a Sole Proprietorship?

As the sole proprietor of a company, a sole proprietor has exclusive control over all business operations and is eligible to earn all profits and gains. He is also responsible for paying for any damages the company suffers.

What are the Compliances required to be followed after obtaining Sole Proprietorship Registration?

After acquiring a Sole Proprietorship Firm Registration, the firm owner must fulfil various compliance requirements. The phrase "compliance" refers to the filing of TDS returns, ITR returns, GST returns, financial statement draughts, tax audits, and purchase and sale invoice documentation.

What are the advantages of the Sole Proprietorship Firm Registration?

Individual investment, ownership, no sharing of profit or loss, fewer compliances, and complete control and responsibility over business activities are benefits of a sole proprietorship firm registration.

Can I pay myself a salary, being the sole proprietorship?

No, a lone proprietor is not allowed to pay himself a salary. However, doing so indicates that the person is moving money from one account to another.

What happens to the property when a sole proprietor dies?

A Single Ownership After a sole proprietors passing, the business is no longer in operation. All of the company's assets and liabilities also become a part of the decedent's estate.

When to File an Income Tax Return for a sole proprietorship in India?

A sole owner may file an ITR-3 or ITR-4 under the presumptive income tax system if he or she has both professional and business income.

What are the Consequences of Violating the FSSAI Rules and Regulations?

An FBO (Food Business Operator) will be responsible for paying the fine if they violate any rules or sections of the FSS Act, 2006 (the "Act"). The FSSAI Act also specifies penalties for several forms of non-compliance.

Is it necessary to Display the FSSAI Logo and License number on the Label of Food Package?

Yes, it is required to display the FSSAI emblem and License number on the label or food package, according to the FSSAI's rules.