A firm is wound up when all commercial activities are stopped, transactions are stopped, and all company assets are sold to other people or businesses in order to pay off any outstanding debts. When the company's obligations are paid off, the residual assets will be distributed to shareholders in proportion to their capital investments.

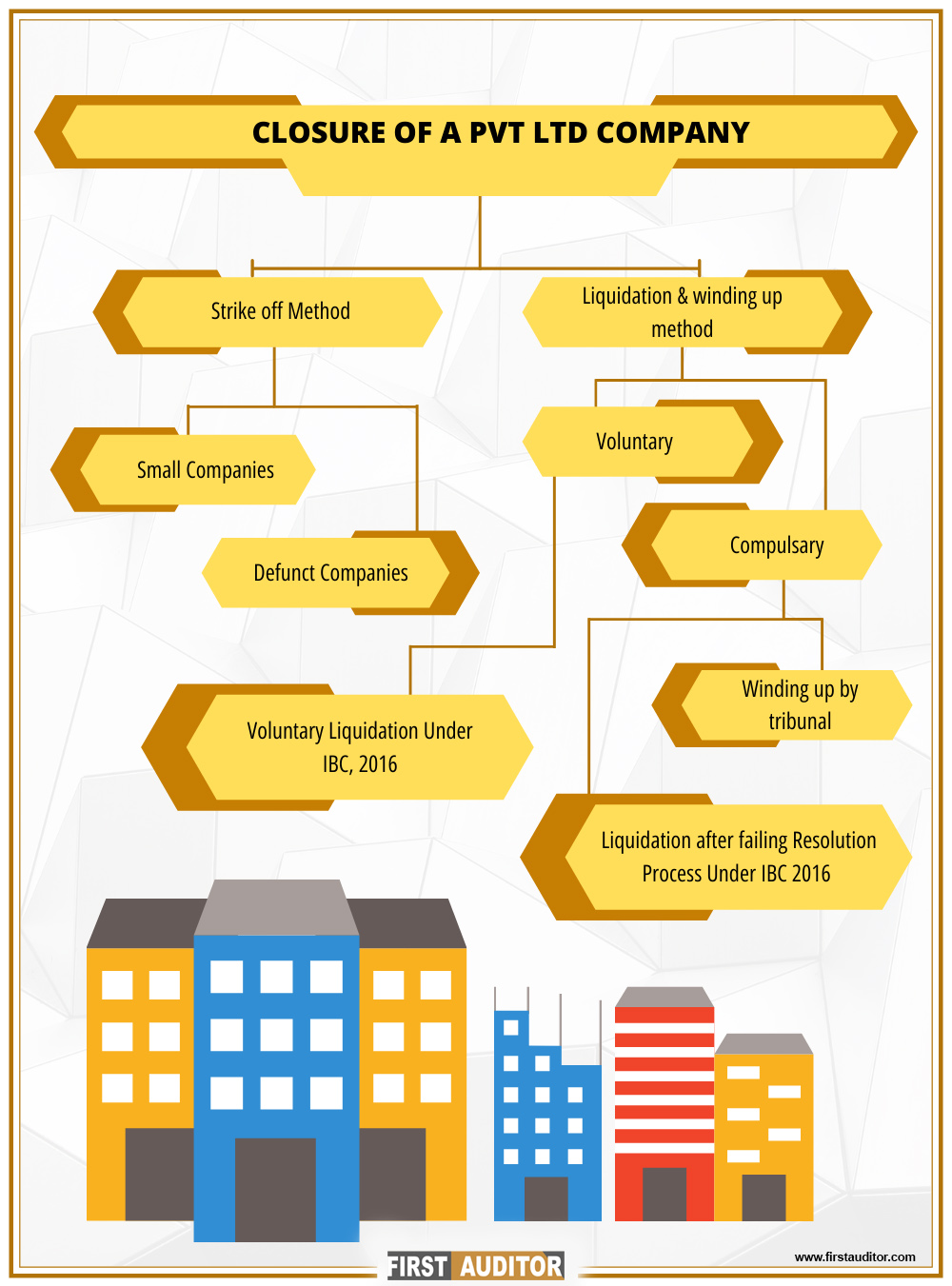

There are two methods that can be used to wind up the business. Mandatory winding up A special resolution passed by the directors during the company's board meeting that requests a court intervention might be disregarded in favor of the compulsory winding up of a company being carried out by a tribunal or court order. Similar to this, if the company has engaged in any fraudulent or unlawful actions, it may be forced to wind up by any official person of the firm submitting a petition with a court or a tribunal.

Voluntarily dissolving: The Corporation needs a resolution from the directors in order to dispose off all of its assets or transfer its stock to another organization

After the liquidation procedure is complete, all directors and corporate officers are released from all debts and obligations to creditors.

If the resolution is approved willingly by the board of directors, they will ignore any legal action brought by the court or the tribunal and give the company's directors a platform to focus on other commercial prospects.

Because fees will be assessed on the sale of assets, the cost or costs associated with the liquidation process are modest.

Any lease that a corporation or other entity had signed for a set period of time will be terminated, together with all of its terms and conditions, during the liquidation process. Any fines that must be paid will be taken out of the proceeds from the sale of assets.

Following a protracted legal battle, creditors will gain from the liquidation process since they will be qualified for a default payment with regard to the proposal of credits given by all creditors.

The process involves obtaining shareholder consent, filing necessary forms with the Registrar of Companies, and settling all debts and liabilities before initiating the closure.

The closure process typically takes 2 to 3 months, depending on the specific circumstances and compliance with legal requirements.

Yes, there are fees for filing necessary forms and documentation with the Registrar of Companies, which can vary based on the company's capital and liabilities.

All assets must be sold or distributed to shareholders, and any outstanding liabilities must be settled before finalizing the closure.

Once a company is officially closed, it cannot be reopened. However, a new company can be formed under a different name if desired.