Within 30 days following the resolution's passage, the company's directors must register it with the Registrar of Companies in order to close an LLP. A statement of assets and liabilities from the date of account closure to the date of the LLP's dissolution, attested by at least two partners, must be submitted within 15 days after the resolution's passage. It is necessary to compile a report on the asset appraisal of the organisation. Once this has been accomplished, the majority of partners must sign a declaration stating that the LLP has no debts or is able to settle all debts within a time limit no longer than one year following the date of the company's dissolution.

You can choose from a variety of alternatives when registering a business, such as LLP or Limited Liability Partnership. Whether or not your firm is conducting business, you must file necessary returns if you registered it as an LLP. If you don't file the returns, the LLP will face LLP Act penalties, and the partners in the company will also be subject to such penalties. Thus, in the case of LLP, filing returns becomes a requirement.

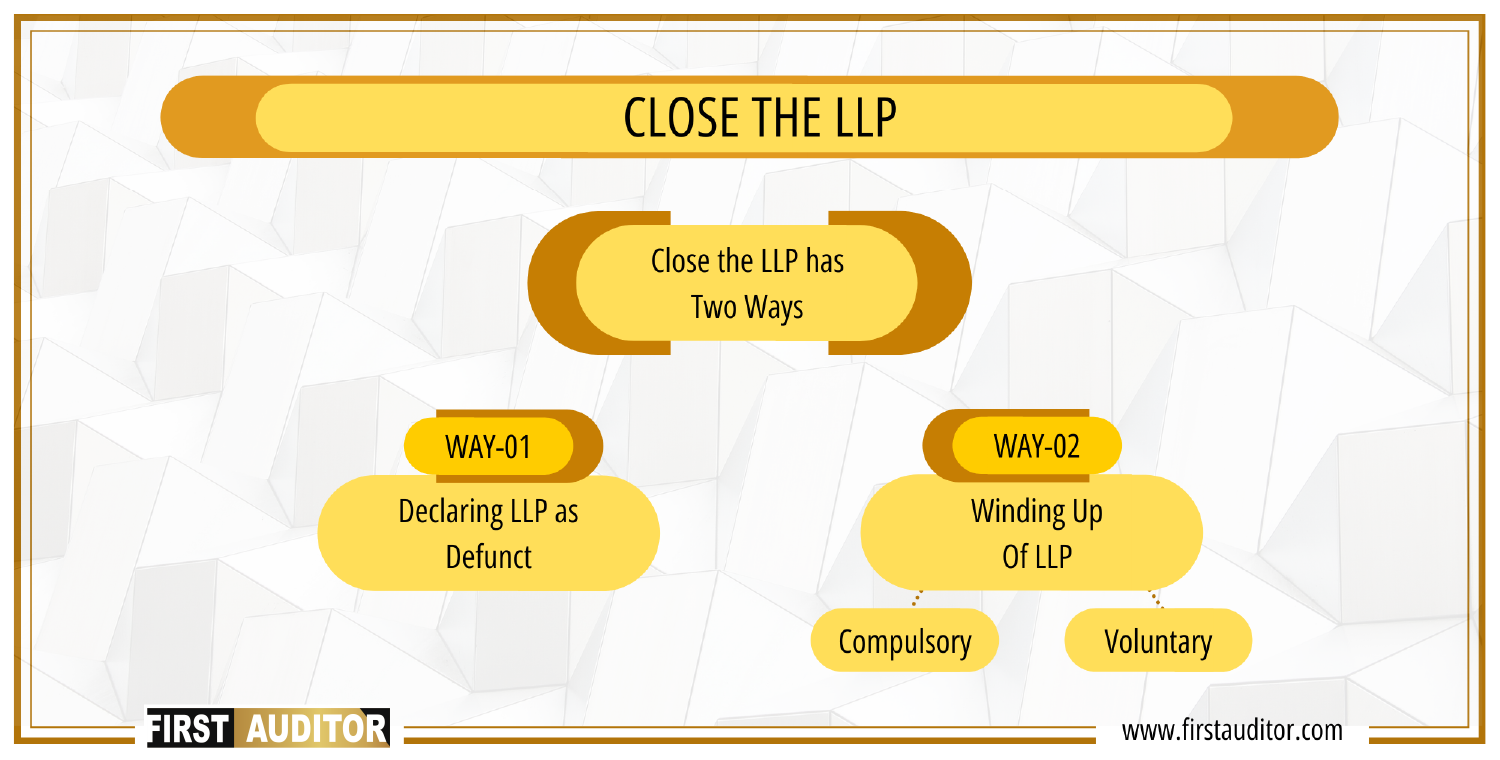

To close an LLP, obtain partners' consent, settle liabilities, and file Form 24 with the Registrar of Companies.

Documents include the LLP Agreement, partner consent, financial statements, and statement of accounts.

The process generally takes about 15-20 business days, depending on processing times.

Yes, there are filing fees and charges for obtaining necessary clearances, which can vary.

Assets are distributed among partners after settling all liabilities according to their share.