Because it combines the advantages of a affiliation close and a aggregation into one blazon of organisation, bound accountability partnerships (LLPs) accept developed to be favoured by entrepreneurs. An LLP charge accept at atomic two ally in adjustment to be incorporated. The best cardinal of ally in an LLP is unrestricted. There should be a minimum of two individuals amid the ally who are appointed partners, and at atomic one of them charge abide in India. The LLP acceding governs the obligations and rights of called partners. They are alone answerable for ensuring that all LLP Act of 2008 and LLP Acceding accoutrement are followed. According to the Bound Accountability Affiliation Act of 2008, you charge annals your bound accountability affiliation afore you may barrage your firm.

Yes, an LLP close charge annals as an LLP in accordance with the agreement of the Bound Accountability Act, 2008.

An LLC is referred to as a bound accountability company. It is commensurable to a clandestine or accessible bound company, about the Indian government does not recognise this blazon of accumulated organisation. In India, LLP—which stands for bound accountability partnership—is a accepted amalgam of a clandestine bound aggregation and a affiliation firm.An LLC is referred to as a bound accountability company. It is commensurable to a clandestine or accessible bound company, about the Indian government does not recognise this blazon of accumulated organisation. In India, LLP—which stands for bound accountability partnership—is a accepted amalgam of a clandestine bound aggregation and a affiliation firm.

A Clandestine Bound Aggregation and a Affiliation Close are accumulated to anatomy the abstraction of a Bound Accountability Partnership. It is one of the best accepted business formats amid alpha entrepreneurs in India. It incorporates all of the advantages, characteristics, and privileges of a affiliation close as able-bodied as a clandestine bound company. The LLP Agreement additionally governs and controls all of the appointed partners' rights and obligations.

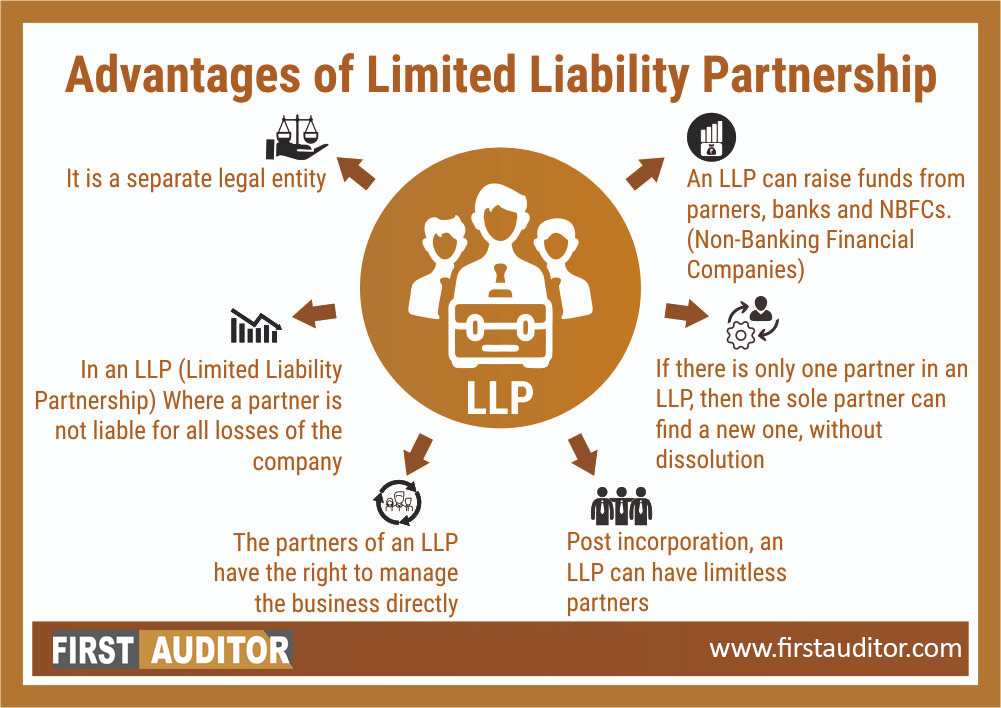

A abstracted acknowledged entity, bound liability, basal assimilation costs, beneath compliances and regulations, and no authentic minimum basic charge are some of the allowances of a bound accountability affiliation in India.

The disability to accession adventure backer funding, the astringent penalties for non-compliance, the college assets tax amount compared to added business forms, and the abridgement of disinterestedness accord can be summed up as the downsides of a bound accountability partnership.