In India, LLPs are required to file their Annual Return within 60 days of the end of the fiscal year and their Statement of Account & Solvency within 30 days of the end of the six-month period after the end of the fiscal year. In contrast to corporations, LLPs are required by law to continue using the April 1 through March 31 fiscal year. As a result, each financial year's Statement of Account & Solvency is due on October 30 and the LLP annual return is due on May 30. LLPs are required to file income tax returns each year in addition to the MCA annual return.

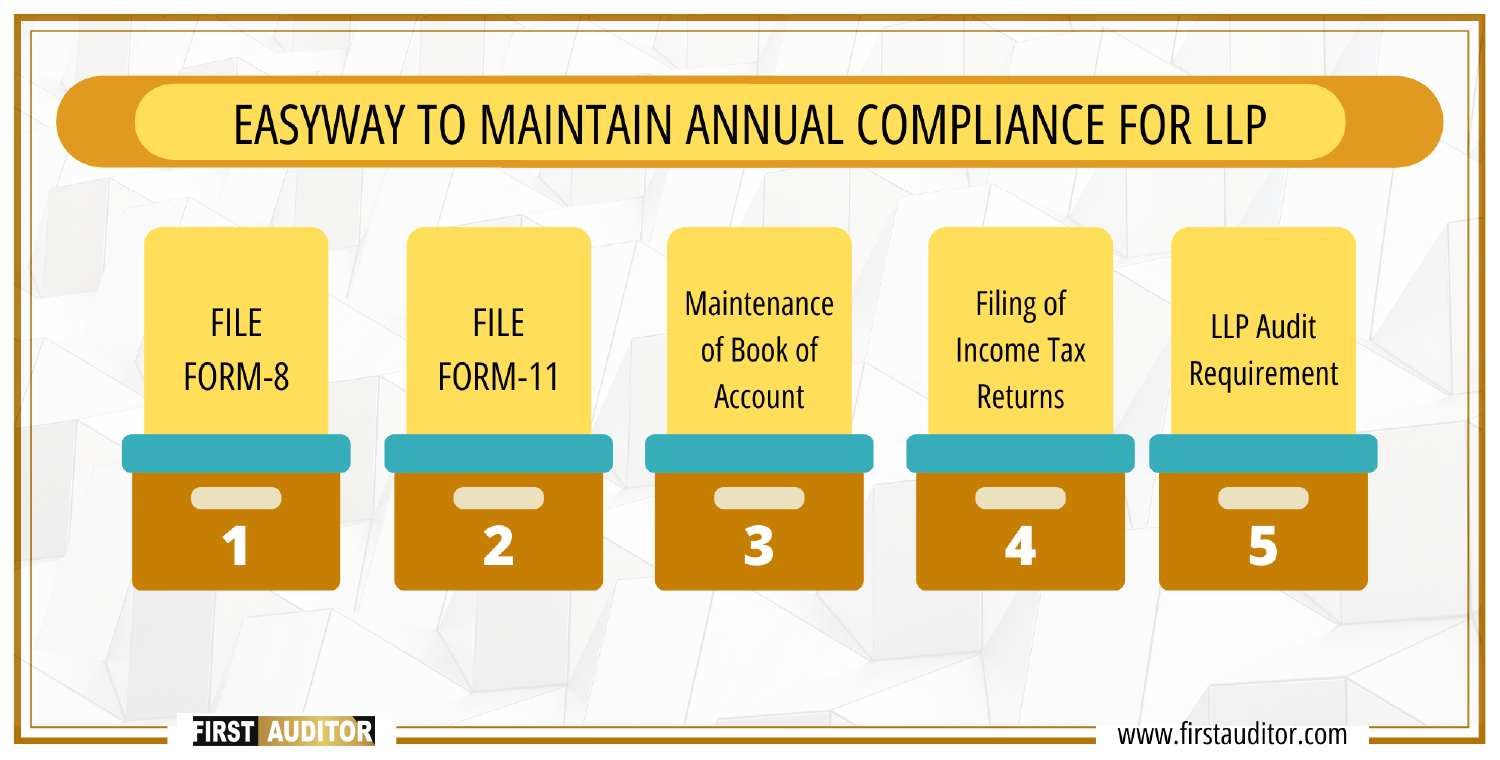

Annual filing for an LLP involves submitting necessary documents such as financial statements and annual returns to the Registrar of Companies to maintain compliance with statutory requirements.

Annual filing ensures legal compliance, avoids penalties, and provides transparency regarding the financial status and operations of the LLP, which is essential for stakeholders.

Required documents typically include financial statements, the LLP agreement, partner details, and compliance certificates from designated partners.

The deadline for annual filing of an LLP is usually within 60 days from the end of the financial year for the annual return and 30 days for financial statements.

Late filing can lead to penalties, including fines and possible legal consequences, which can affect the LLP’s status and credibility.