Investors typically carry out due diligence to verify that the company consistently complies with all applicable laws and business procedures. Prior to any bank loan funding, business sale, private equity investment, or other transaction, a corporation typically undergoes due diligence.

The company's compliance, financial, and legal elements are typically examined throughout this procedure and documented. Before a formal contract is signed by both parties, it is the process of evaluating all the relevant facts of a business or contract. Due diligence on the purchase is not just restricted to the buyers; sellers can also do it. Factual, background, legal, and accounting checks are all part of the due diligence process. To avoid unpleasant shocks after a sale is closed, this is done.

A company's due diligence procedure starts at the Ministry of Corporate Affairs (MCA). The master information on a company is made available to the public on the website of the Ministry of Corporate Affairs. Additionally, for a modest price, anyone can access all documents submitted to the Registrar of Companies. In general, this information from the MCA website is first checked. The data and paperwork acquired in this step consist of the following:

Due diligence services involve the investigation and evaluation of a business or individual before a transaction, helping to uncover potential risks and liabilities.

It helps investors and companies make informed decisions by identifying potential issues, thereby minimizing risks in mergers, acquisitions, or partnerships.

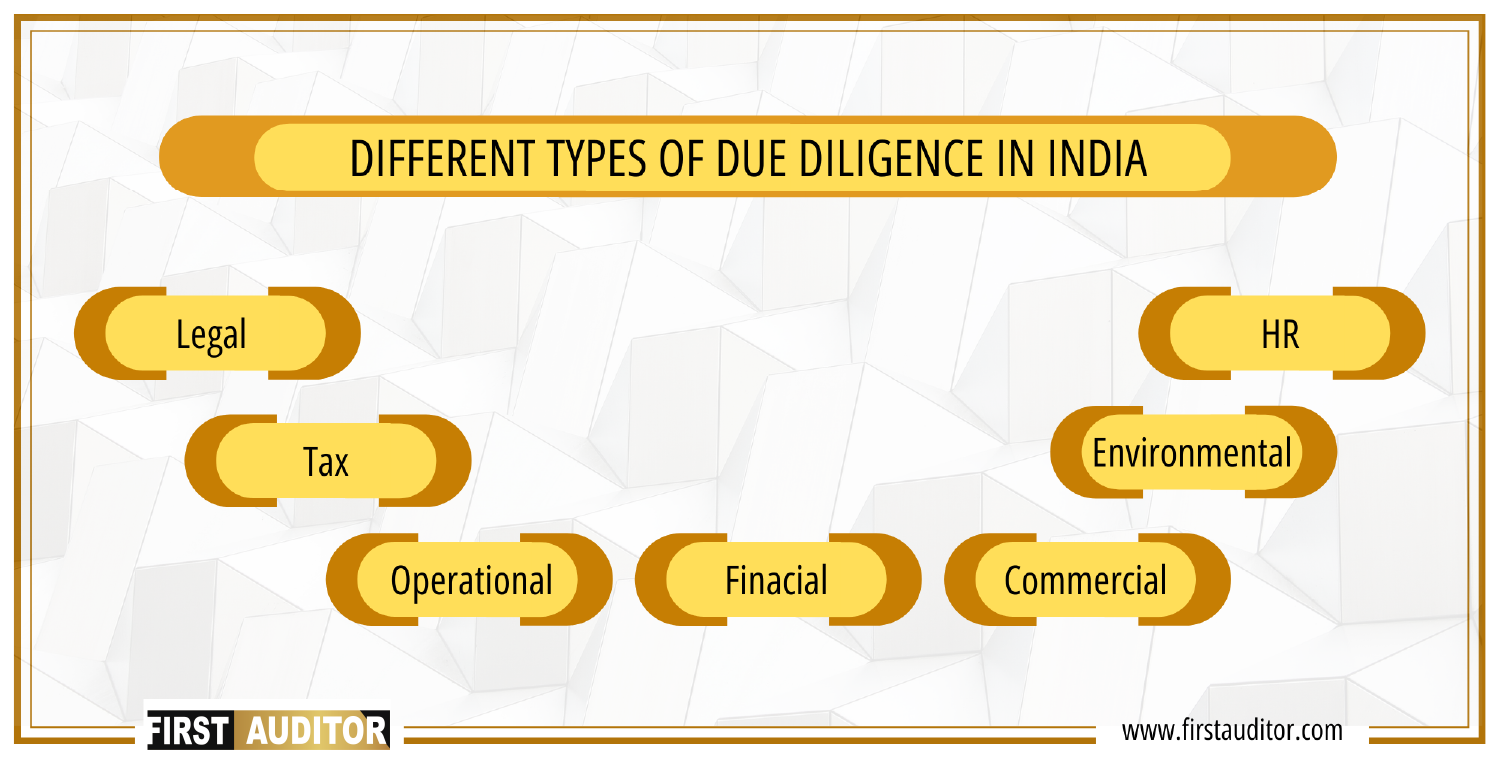

There are various types, including financial, legal, operational, and commercial due diligence, each focusing on different aspects of a business.

The timeline varies based on the complexity of the transaction but typically ranges from a few days to several weeks.

A due diligence report can include findings on financial health, legal compliance, operational effectiveness, and market positioning.