A company recognised under section 406 of the Companies Act of 2013 as belonging to the non-banking financial sector in India is known as a nidhi company. Their primary activity is the lending and borrowing of funds among their members. They are also referred to as Mutual Benefit Companies, Benefit Funds, Mutual Benefit Funds, and Permanent Funds.

The goal of such a company would be to instill in its members a habit of being frugal and saving money, and the services would only be available to members.

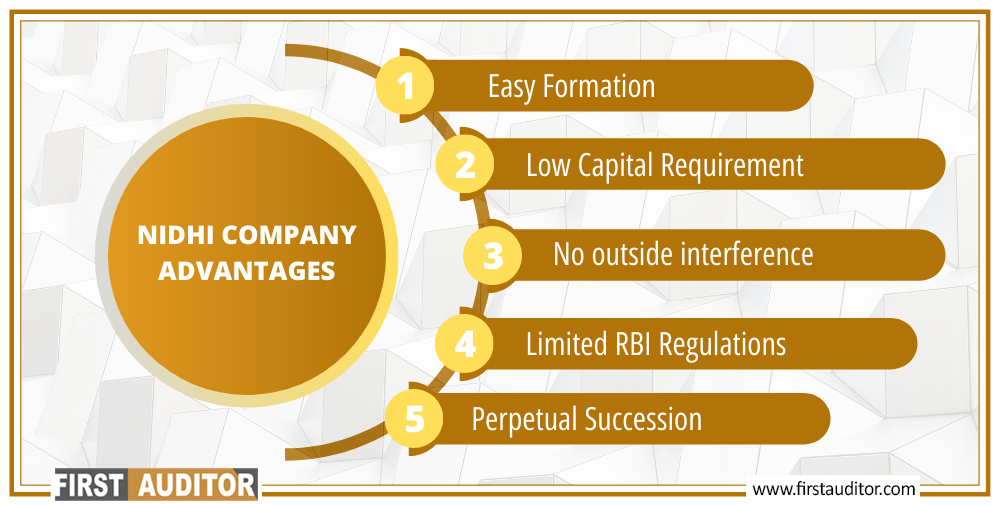

A Nidhi Company must have a minimum capital of Rs. 5,00,000 to be incorporated.

A Nidhi business must be publicly traded.

Setting up a Nidhi Company takes an average of 15 business days to complete.

It is required to include "Nidhi Limited" in the company name, yes. The phrase "Mutual Benefit" can also be used, though.

A Nidhi Company must have a minimum of three directors and seven shareholders in order to be incorporated.

The Nidhi Company Registration process is entirely online, therefore there is no need for anyone to come to our office in person.

ID proofs, address proofs, the most recent bank statements, and address proofs for the registered office are the main documents needed for Nidhi Company Registration.