According to the Companies Act of 2013, which creates a mechanism to convert one class of company into another, the conversion of a PLC (Private Limited Company) into an OPC (One Person Company) is permitted. Beginning on April 1, 2014, Section 18 of the Act expressly permits the conversion of a private limited company that is already registered.

The responsibilities and contractual obligations of the business before to conversion would not be affected by the conversion of PLC to OPC; these claims, liabilities, and obligations would continue to be legally enforceable, and the resulting OPC would be responsible for them.

Borrowing is a common necessity for businesses. In sole proprietorships, the owners are fully responsible for all debt. Therefore, the owner would have to sell his or her car, house, or jewellery to pay it back if the company could not. In an OPC, all personal property would be safe and just the money used to launch the firm would be forfeited.

In contrast to an OPC, if a promoter operated as a single proprietorship, the firm would stop with his or her passing. An OPC will transfer to the nominee director and continue to exist since it has a distinct legal identity.

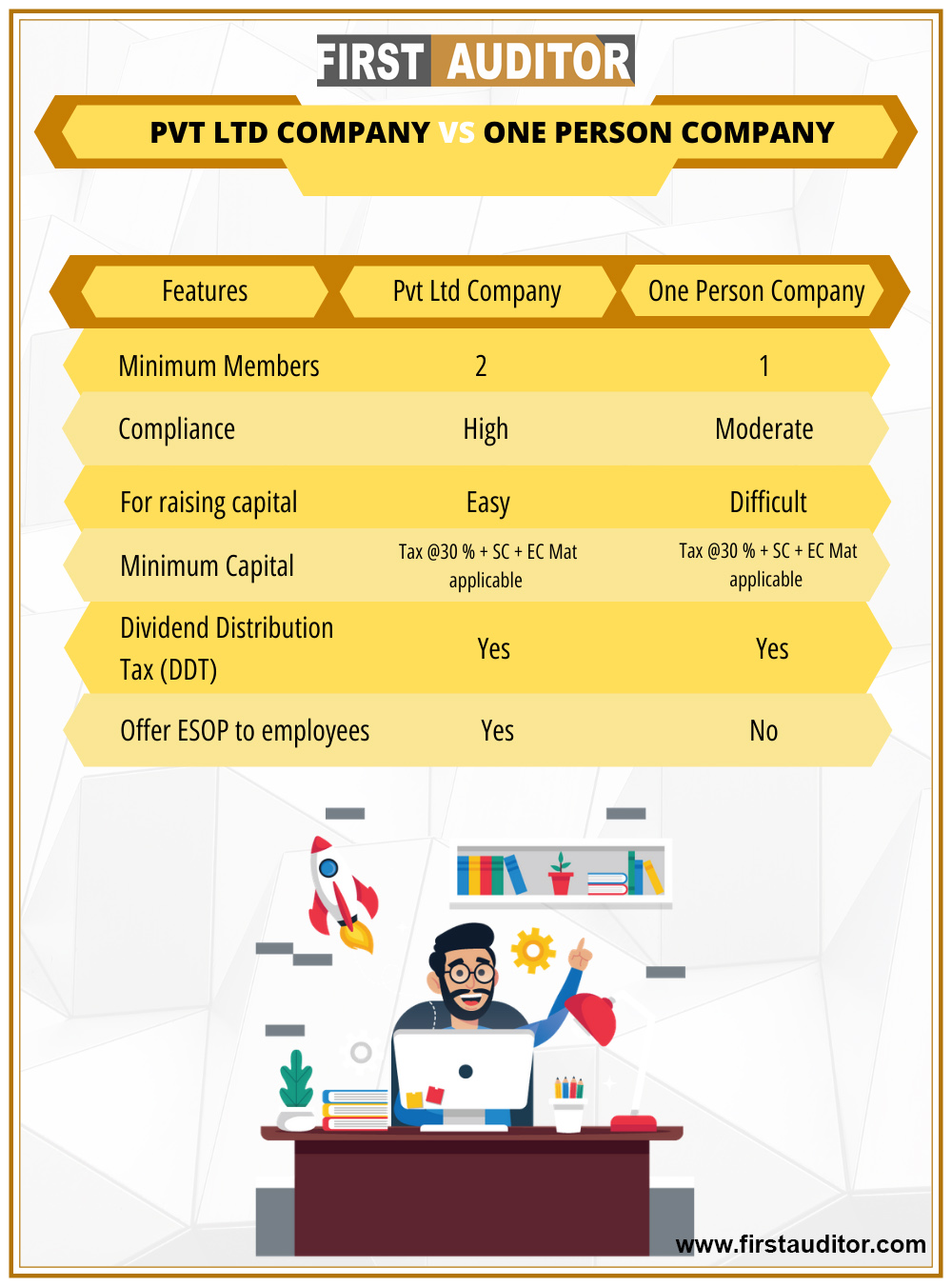

Share certificates and statutory registers are the only annual filings allowed because an OPC can only have one director and one shareholder.

The conversion involves passing a special resolution, amending the Memorandum and Articles of Association, and filing specific forms with the Registrar of Companies to reflect the change in structure.

Documents required include a special resolution, updated Memorandum and Articles, and Form INC-6 for filing with the Registrar.

Yes, a single-person company must have at least one member and a nominee to take over in case of incapacity.

Advantages include limited liability, simplified compliance requirements, and enhanced credibility in business transactions.

The process typically takes 15-30 days, depending on document submission and regulatory approvals.