The Company's Act of 2013 alien a atypical abstraction on the One Actuality Aggregation (OPC). A clandestine aggregation charge accept a minimum of two admiral and members, but a accessible aggregation charge accept a minimum of three admiral and seven members. Until recently, alone a accumulation of bodies could absorb a company.However, as of today, a aggregation can be founded with aloof 1 Administrator and 1 Member, afterward Section 2(62) of the Company's Act 2013. It is a blazon of association with beneath acquiescence obligations than a clandestine corporation.

Application for DSC and DIN, Name Approval Application, Documents Required, Filling Out Required Form With The MCA, and Issuance of Certificate of Incorporation are all Parts of the One Person Company Registration Process in India.

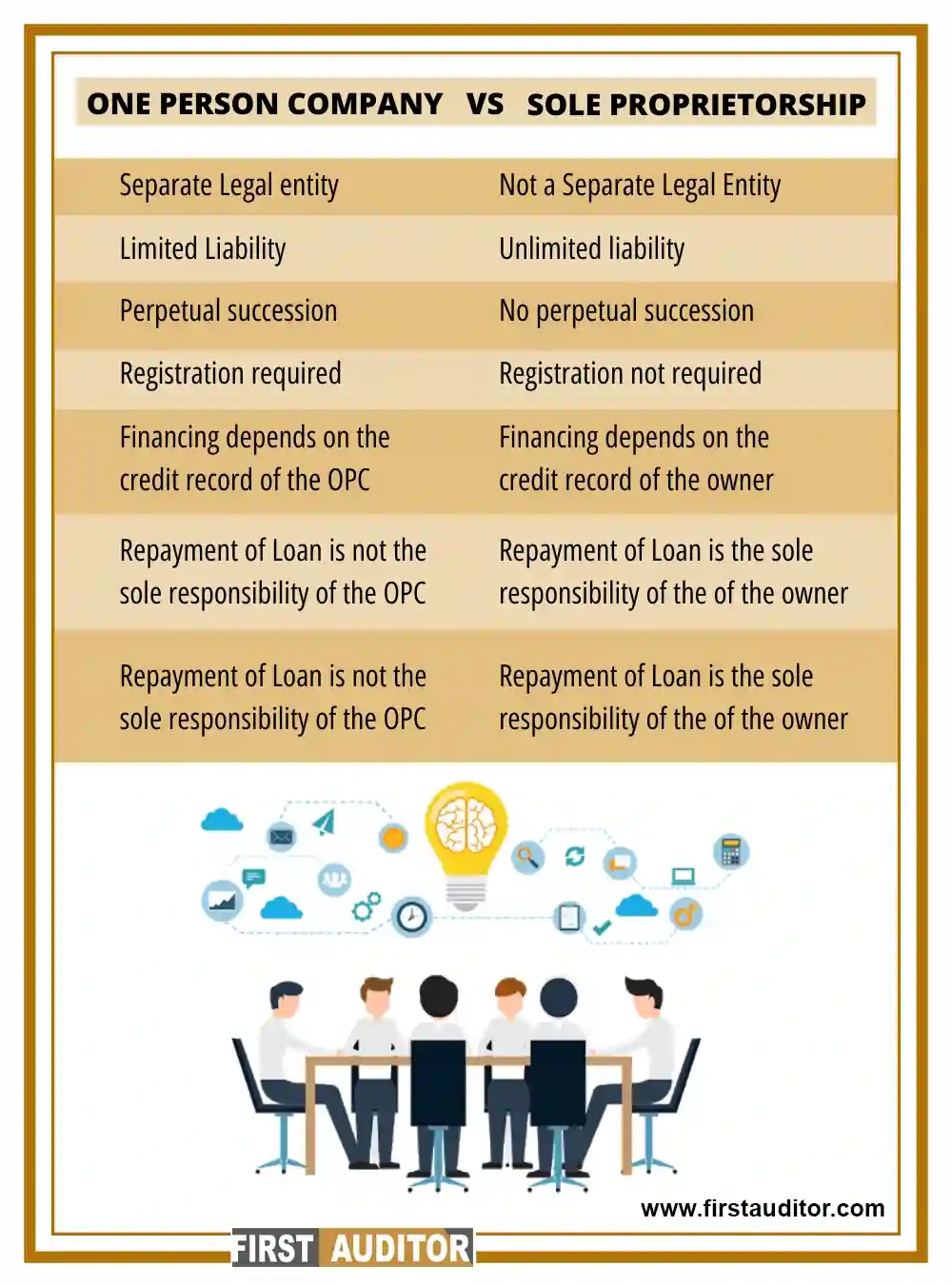

According to Section 2 (62) of the Companies Act of 2013, a company is referred to as a "One Person Company" if it only requires one member. Additionally, this corporate structure's shareholder or member is also a subscriber to its MOA (Memorandum of Association).

OPC Registration in India typically takes place over the course of 7 working days.

An OPC must have Rs 1 crore in authorised share capital to operate in India.

An OPC is assessed a fixed fee of 30% in India, and it is not tax-favored.

Copyright © 2024 First Auditor,All Rights Reserved.