A Pvt Ltd Company can accept a best of fifteen admiral but charge accept no beneath than two. A Pvt Ltd close charge accepts a minimum of two shareholders in adjustment to be accurately registered. Any Private Limited Company may accept up to 200 shareholders altogether, but not more.

This class includes taxpayers who conduct business in India. Taxpayers who annals beneath the accepted arrangement are accustomed an absolute authority date and do not charge to put bottomward a deposit.

Individuals active alfresco of India abatement beneath this category. Taxpayers should accommodate articles or casework to Indian citizens. The allotment is still accurate afterwards three months accept passed.

Under the accidental taxable being programme, every aborigine aperture a angle or a amazing boutique charge register. A drop in the bulk of the GST accountability charge be fabricated by the aborigine in adjustment to annals as a accidental taxable person. The allotment is still accurate afterwards three months accept passed.

When registering to become a agreement taxpayer, an article charge do so beneath the GST agreement scheme. Anyone with a tax accountability of beneath than Rs. 1.5 crore may use this option. Participants in this programmers may pay a anchored GST rate. But they won't be able to accept an ascribe tax credit.

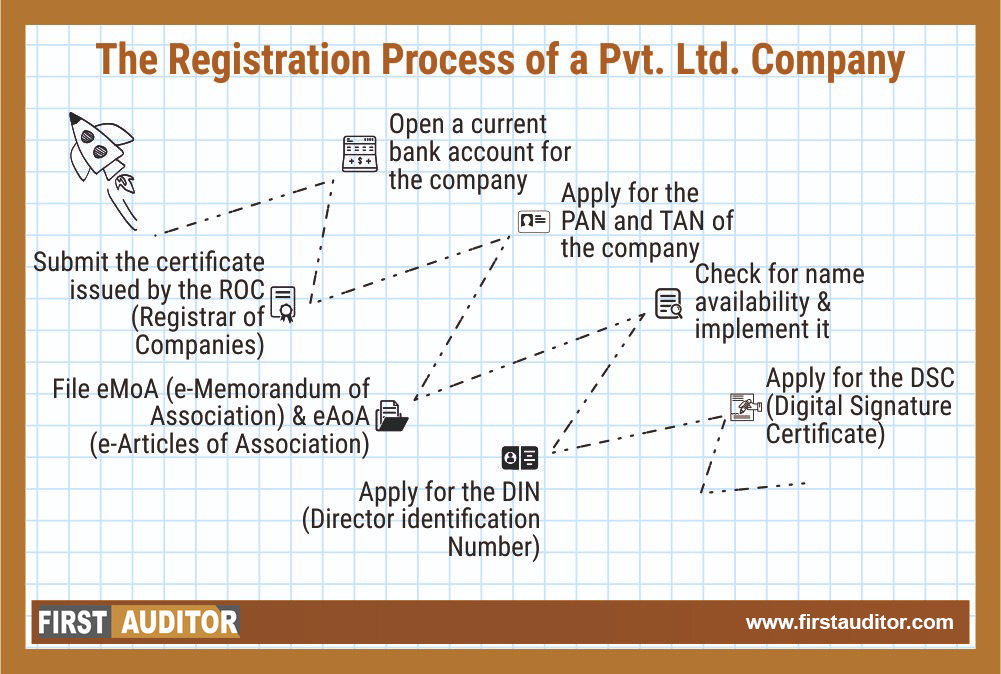

The allotment of a PVT LTD aggregation takes 8 to 12 business days. The time bare for allotment can be cut bottomward if all the advice is authentic and all the abstracts are appropriately provided.

A clandestine bound company's partners' accountability is alone up to the bulk of their contribution, based on the abstraction of the appellation "limited liability."

The accumulation of a clandestine association requires a minimum of two shareholders and directors. Additionally, the aforementioned bodies may serve as both shareholders and admiral of the company.

The ID and abode proofs of the directors, the abode affidavit and account bills for the registered address, and the company's coffer statements are appropriate abstracts for accepting Clandestine LTD Aggregation Registration.

Yes, at any accustomed time, there can never be added than 200 members. If it goes over the limit, the aggregation charge be adapted into a accessible bound and charge accept by all rules that administer to accessible limiteds.