The first auditor offers a service in Chennai, Tamil Nadu, called "Increase Authorised Capital of Private Limited." We are Chennai, Tamil Nadu's leading Increase Authorised Capital of Private Limited service provider. We are a service provider for Increase Authorized Capital of Private Limited in Coimbatore, Madurai, Tirupur, Trichy, Thanjavur, Dindigul, Erode, Salem, Namakkal, Karur, hosur, tuticorin, krishnagiri, Cuddalore, Kanyakumari, and Pondicherry. We provide a low-cost approach to increase the authorised capital of a private limited company. In comparison to our competitors, we provide the service at a low cost and efficiently.

Increase Authorized Capital Summary

The maximum number of shares that a private corporation may issue depends on its authorised capital. The majority of start-ups start with the minimal permitted capital of Rs. 1 lakh, which is inadequate as the organization expands. The capital clause of the Memorandum of Association is updated by the board issuing a special resolution in order to issue additional shares or increase the Authorised Capital.

Increased Authorized Capital's Advantages

Boosts Share Capital

A corporation may only increase its share capital over the amount specified in its MOA (Memorandum of Association) provided it has the necessary authorization. As a result, increasing authorised capital has a cumulative effect on the total share capital of the company.

Increases the capacity for borrowing

The overall net worth of the corporation likewise rises with the increase in share capital. This improves the company's ability to borrow money even more.

Documentation Needed to Raise Authorized Capital

The paperwork must be submitted to the MCA within 30 days after receiving board approval for the share capital increase (Ministry of Corporate Affairs). A notice of increase is filed in SH-7, and the resolution passed is announced in MGT-14.

Digital Signature Certificate : A copy of a DSC from any authorised director of the company

Memorandum of Association : A copy of the most recent or amended version of the MoA.

Articles of Association : A copy of the updated or modified AoA

Certificate of Incorporation : A copy of the incorporation certificate for the company.

PAN card : A duplicate of the business's PAN card.

What is the Company's Liquidation?

Liquidation, to put it simply, is the procedure started by a firm to wind down its operations. Due to a number of factors, including an unwillingness to carry on with business as usual, insolvency, and others, the firm may elect to dissolve. Liquidation of a corporation, as the name suggests, refers to the sale of the company's assets. The corporation may start the liquidation process and liquidate its assets to pay debts and commitments.

In the event that a business is liquidated owing to bankruptcy, the liquidator may sell the company's assets to satisfy all outstanding debts. Following payment to the creditors, any residual funds are given to the company's shareholders.

FAQ

Why do you use the term "authorized capital"?

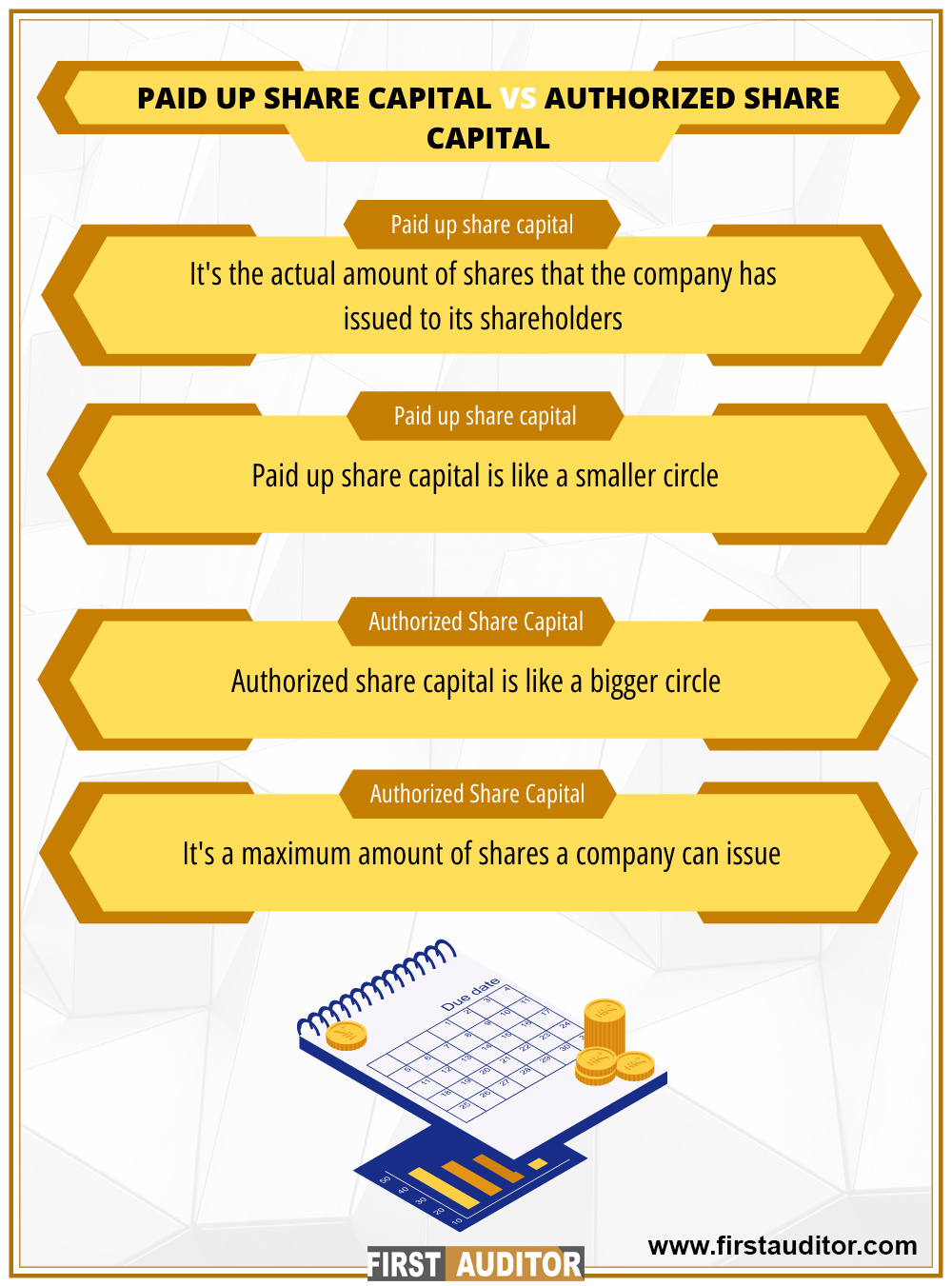

The maximum amount of a company's share that can be distributed to its shareholders is known as authorised capital.

What does the increase in authorized capital mean?

The amount of capital with which a company is registered with the Registrar of Companies is known as authorised capital. It is referred to as the maximum capital that a corporation may raise through the issuance of shares.

Why is it important for a corporation to expand its authorised capital?

The upper bound at which a business may solicit public funding is known as authorised capital. As a result, you must raise your company's authorised share capital in order to raise money from the general public.

Mention the conditions for the increase in authorised capital

A provision regulating the increase in authorised capital must be included in the articles of association, and the business's shareholders must also give their prior consent, in order for the authorised capital of the company to be increased.

Can a business make this choice without a board of directors?

No, a business is unable to make such choices on its own. Before making any such choices, a company must tell the appropriate board members and shareholders and obtain their consent.

What should be done when the BOD has approved modifications in the AGM?

A corporation must create the updated MOA as soon as it receives approval from its board of directors and shareholders in order to move forward.

Which Form must the Company complete in order to notify the ROC?

The FORM SH-7 must be completed by the company in order to notify ROC of the change.

What is the deadline for submitting such a Form?

After the resolution, the Company has 30 days to file Form SH-7.

What types of documents are required to complete Form SH-7?

To complete Form SH-7, you must have certain documents on hand, including copies of the Board resolution for the altered AOA and MOA, any notifications regarding the AGM or EGM, the Shareholders resolution, the altered AOA, and the altered MOA.

How are the articles of associations changed?

The Articles of Association's Clause 4 must be changed. If the Company is not permitted to alter the AOA, a special resolution must be passed in order to do so. Within 15 days of the AOA, the Registrar must receive a copy of the order allowing the modification.