The Employees' Provident Fund is a social security programme that enables employees to set aside a small amount of their wages for future benefits.Every business is required to provide its employees with EPF, or Employees Provident Fund, which is equivalent to a retirement fund. The Employees' Provident Funds and Miscellaneous Provisions Act, 1952, governs EPF. Organizations with a total staff size of more than 20 must register with EPF. In only 3 simple steps, businesses can sign up for employee provident funds:

In some entities the underlying may also be needed :

Along with the employee's contribution to the EPF, the employer also makes a matching contribution that covers the Employee Pension Scheme (EPS). As a result, EPF helps you build a solid retirement.

Provident Fund assists the employee's dependents by assuming the financial risks they face in cases like illness, death, or retirement.

When changing jobs, the PF account can be transferred. The connecting of the earlier accounts will start to be made easier thanks to the Universal Account Number (UAN) connected to Aadhar. Instead of being closed down, it can be transferred to the new employer. This consistency makes sure that the rate of return compounds over time.

Emergencies are inevitable in life and can occur at any time. EPF money can come in very handy for accidents, sickness, marriages, and educational costs. Online claims can be filed by employees.

Anyone who has a PF account is eligible for this insurance programme, which only requires a premium deduction of 0.5% of the employee's pay.

For long-term objectives like purchasing a home or creating a fund for children, the PF account can be of great assistance.

By making a missed call from their registered cellphone number to 011-22901406 they can obtain the information that is available at the Employee Provident Fund Organization (EPFO) for members who have registered under the UAN portal. The member can readily obtain information about their PF balance and prior contributions if their UAN is connected to their bank account number, PAN card, or Aadhar number.

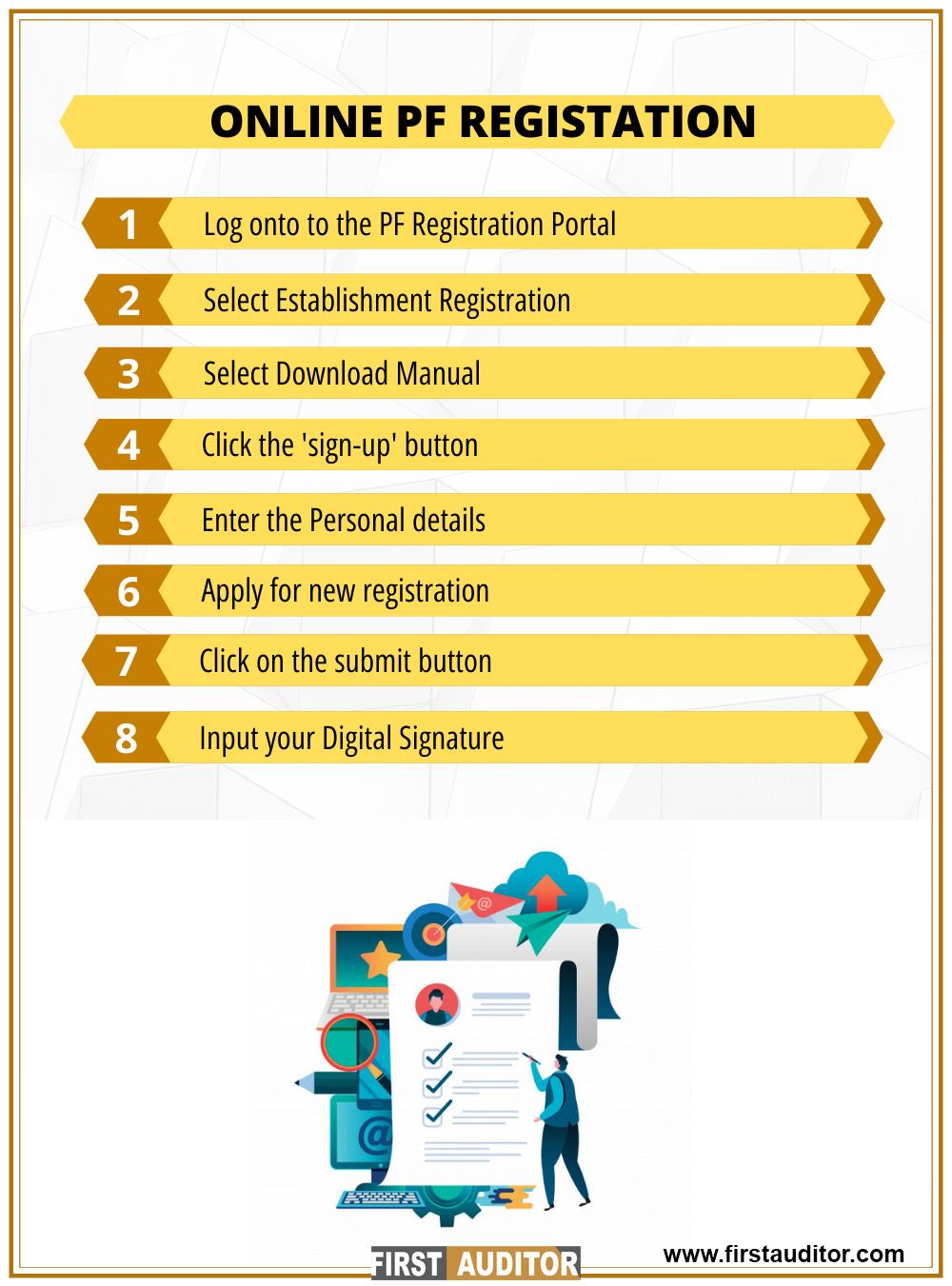

PF Registration refers to the process of registering a business under the Employees' Provident Fund and Miscellaneous Provisions Act, 1952. It is mandatory for establishments with 20 or more employees, ensuring workers receive provident fund benefits.

Any organization or establishment with 20 or more employees is required to register for PF. This includes factories, businesses, and certain service establishments.

Documents required for PF Registration include the establishment’s PAN, registration certificate, employee details, and bank account details. Additional documents may be needed depending on the type of business.

The PF Registration process typically takes about 15 to 30 days, depending on the completeness of the application and the verification process by the Employees' Provident Fund Organisation (EPFO).

PF Registration provides numerous benefits, including financial security for employees upon retirement, employee contributions to savings, and tax benefits for both the employer and employees.

Yes, employers are required to contribute to the PF. The contribution is a percentage of the employee’s basic salary and is matched by the employee’s contribution.

Failure to register for PF can result in penalties, including fines and legal action. Employers are also liable to pay the dues of their employees along with interest and penalties for non-compliance.

To initiate the PF Registration process, contact us for expert assistance. We will guide you through the documentation and application process, ensuring compliance with all requirements.