The Government of India launched the Employee State Insurance (ESI) programme to provide workers with financial, medical, and other benefits. Employee State Insurance Corporation, an independent agency that reports to the Ministry of Labor and Employment, is in charge of managing ESI.Any business with more than 10 employees is required by law to have ESI. There are 20 employees in some states.

Registered ESI members and their families are entitled to the advantages of comprehensive medical care and insurance starting on the first day of employment.

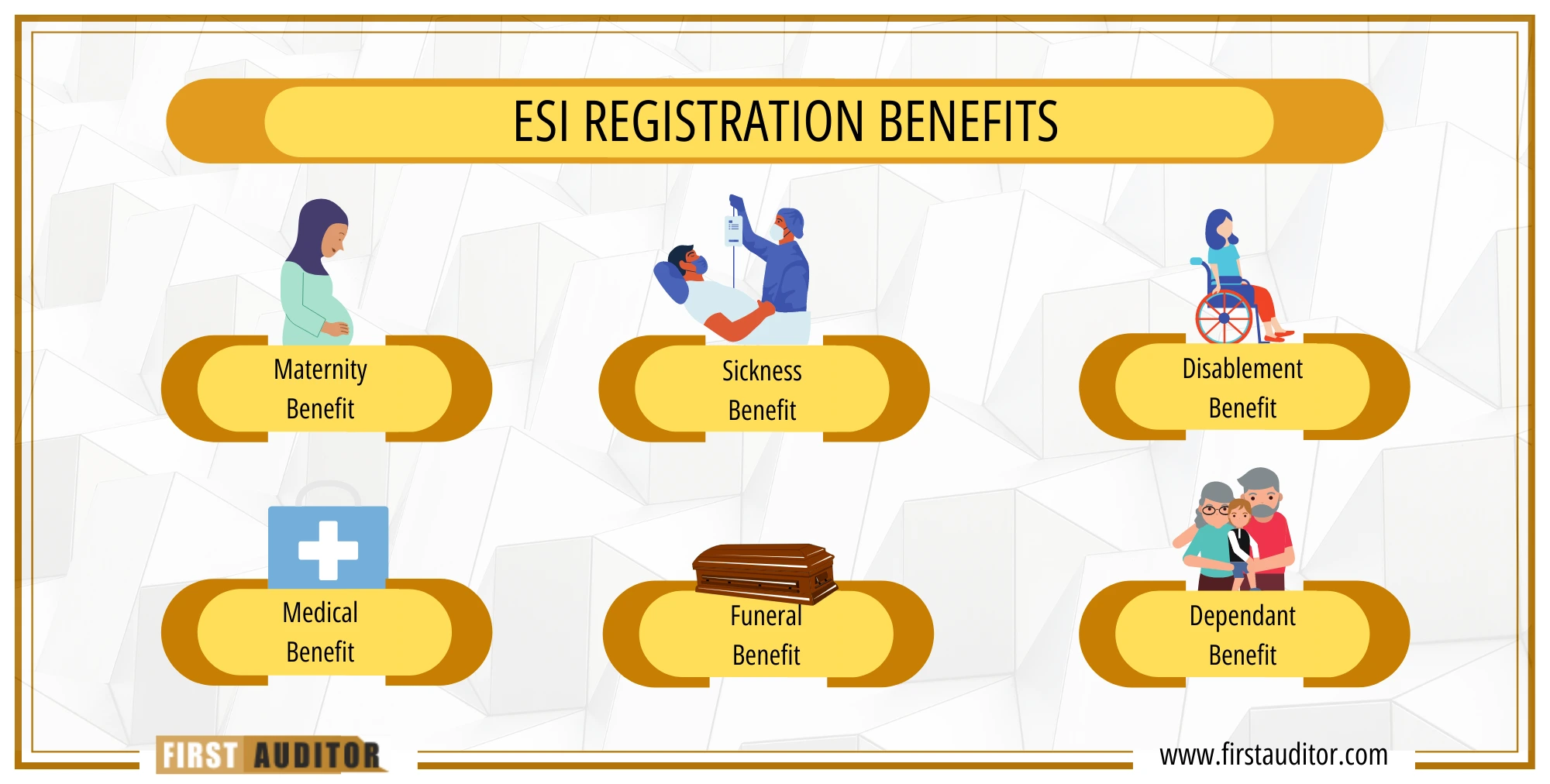

Maternity benefits are available to expectant mothers and are payable for up to 26 weeks. On medical recommendation, this period may be prolonged by 30 days. Employers must have contributed their earnings for 70 days in the previous two contribution periods in order to be eligible for maternity benefits.

As disability payments, disabled workers are eligible to receive 90% of their monthly income.

A maximum of 91 sick days and 70% of the monthly salary may be taken off from work each year.

In the tragic case that an employee passes away while still working, the deceased's dependents will get 90% of their monthly wage.

Under the ESI system, confinement expenses may be claimed in the event that an insured woman or an employee's wife gives birth in a location without medical services. Additionally, some of the need-based advantages include:

Employees with a physical disability who are insured are entitled to receive vocational rehabilitation training at VRS.

ESI Registration refers to the process of registering an organization under the Employees' State Insurance Act, 1948. It provides social security benefits to employees in case of sickness, maternity, or employment injury.

Every organization with 10 or more employees, who earn below a specified wage limit, is required to register for ESI. This includes factories, shops, and establishments across various sectors.

Documents required for ESI Registration include the establishment's PAN, registration certificate, employee details (name, age, etc.), and bank account details. Additional documentation may vary based on the business type.

The ESI Registration process typically takes about 30 days, depending on the completeness of the application and the verification process by the Employees' State Insurance Corporation (ESIC).

ESI Registration provides employees with various benefits, including medical care, maternity benefits, and financial support during periods of unemployment or injury, thereby ensuring their welfare.

Employers contribute 3.25% of the employee's gross salary towards the ESI scheme. Employees contribute 0.75% of their wages, and both contributions are paid to the ESIC.

Failure to register for ESI can result in penalties, including fines and legal action. Employers may also be liable for any claims made by employees for benefits they would have received under ESI.

To initiate the ESI Registration process, contact us for expert assistance. We will help you with the necessary documentation and guide you through the application process.

Copyright © 2024 First Auditor,All Rights Reserved.